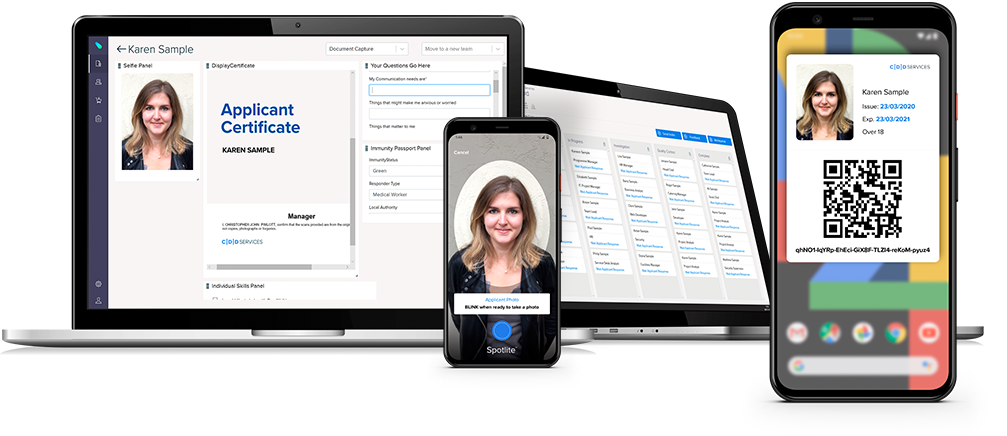

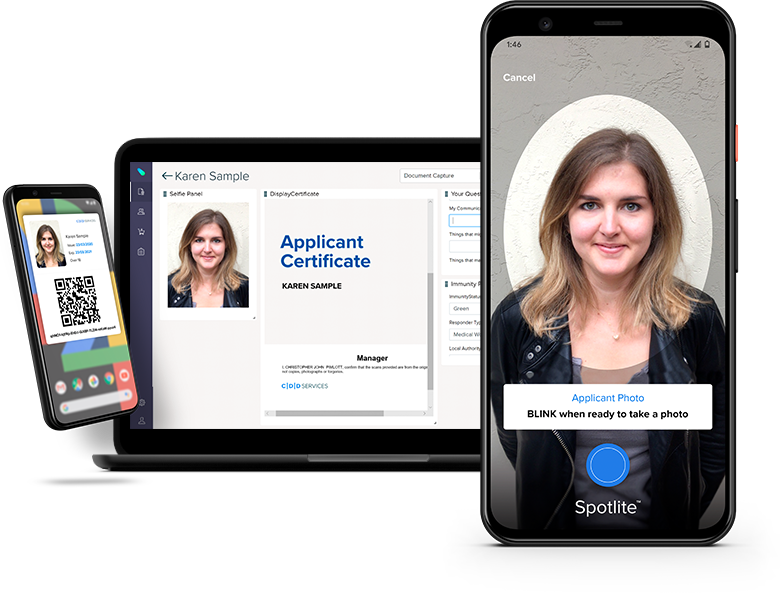

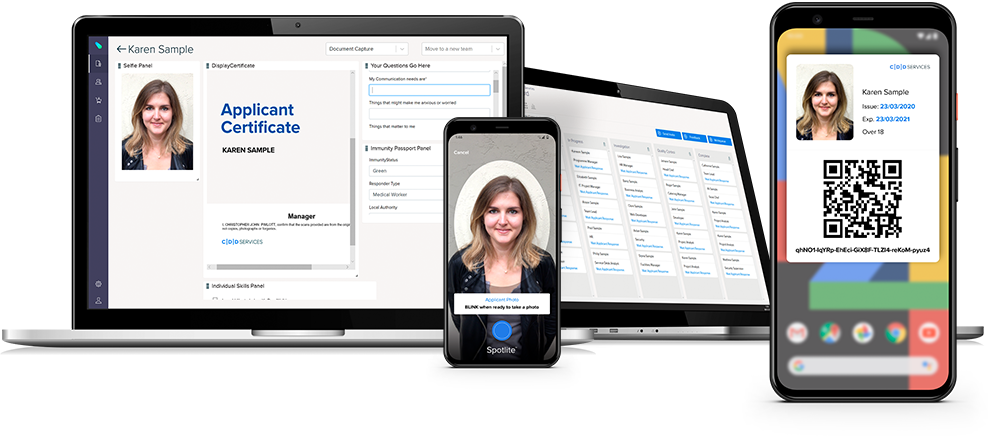

New! Integrated Right To Work, ID & DBS Checks In One App

Identity & Document Verification Solutions

Faster, safer and customised to your needs

Spotlite does it all

Most popular services

ID Verification

Fast and secure employee checks without the need for utility bills or in person vetting.

DBS

Fast and secure – the only Government approved mobile solution that combines, ID verification, right to work and DBS in one app.

What people say

Would I recommend this service? 100% yes, and I already have done.

People who make it happen

We share a vision to deliver regulatory technology that enables business success

A business and technology hybrid, with an innovative vision and the focus on transforming how organisations can simplify compliance, risk and financial crime management.

Global leadership consultant to blue chip companies and the CDD HR Director. Our business psychologist and creative culture change champion.

Identity and Fraud prevention evangelist with extensive knowledge of OCR, digital transformation, biometrics and data sharing. A data privacy and social good advocate.

Get back to what you do best

We have enabled UK leading brands for over 16 years, and successfully delivered global digital transformation and compliance projects to numerous regulated companies.

We’ll help you evidence compliance and control, deliver quality and help you and your clients.

Impress, grow confidence and trust. It’s time to adapt.

We are the future of proof.

We facilitate rapid access to services and rapid mobilisation of resources. We perform traditional due diligence quicker with new digital and AI tools.

Spotlite allows you to onboard Customers, Human Resources and Suppliers quicker and safer than before. Our Perpetual Compliance functions ensure that your organisation’s on-going compliance with your regulatory and policy risk standards.

We have two products:

Spotlite Compliance Platform: a B2B product that allows our clients to complete due diligence checks on new customers, staff, and suppliers.

SafeGuarden: a C2B product that allows an individual to store and share their personal data with one or more businesses.

Spotlite and SafeGuarden can be used independently or combined to help communities work together as one.

Save money. Stay compliant.

We use digital technology to turn necessity into competitive advantage and get things right first time.

- We deliver a significant reduction in costs, improved evidence of compliance and a positive transformation in the way you deal with your staff and customers.

- From as little as £2 per applicant, we have a set of easy start Service Packs available off the shelf to suit your compliance need and budget

- Spotlite’s apps, digital ID and CRM allow you to exercise persoanlised experiences for your customers and staff while at the same time maintaining consistency of process and control of costs.

- Comprehensive Management Information comes as standard. You have full oversight and understanding of the risks and issues across your business. Ready to go day one.

- Privacy, security and GDPR compliance are bult in. We have worked with the ICO as part of their Sandbox initiative to ensure Data Protection by design.

- Subscriptions available for pay-as-you-go through to enterprise wide multi-jurisdictional support. We also provide options for white label, private cloud and internal infrastructure deployments.

From Compliance to Excellence: Let's Shape the Future

The next stage of the UK digital trust framework will be released in 2024. This will help individuals share data and organisations reduce costs. However, the framework isn’t just about digital identity; it’s about fostering a collective vision of a better world.

Picture this: A data economy where individuals control and own their data in their own personal data stores. When onboarding a new customer, employee or supplier, organisations seamlessly accept and individual’s validated identity and verified credentials with just a tap on a smart device or a click online. Achieving this world isn’t just about adopting new standards; it’s about a fundamental shift in how we approach our work.

At CDD Services, we are more than just advocates for compliance; we are catalysts for meaningful transformation. We are committed to seamlessly integrating new compliance practices into everyday workflows, much like how Apple designed intuitive devices that even a child can use. This requires embracing a different mindset.

We understand that each business has its unique goals and challenges. That’s why we partner with you to cultivate the leadership, talent, with digitally enabled AI processes to propel your organisation forward.

Our mission? To empower you to enhance performance, cut costs, and realize the change you aspire to see. Because ultimately, it’s the change we all need.

For further insights and information, express your interest below. Let’s embark on this transformative journey together.

Change your business future. Build confidence and trust with digital impact. It’s time to adapt.

Get in contact / request a demo

and we will respond to you as soon as possible.

Manchester Digital Innovation and Security Hub,

Heron House, 47 Lloyd St,

Manchester, M2 5LE